Do You Have a Business or Just a Job? The Profit First Method Explained 🚀

ASE's Weekly Takeoff - March 2nd, 2025

Hello friends,

Have you ever stopped to ask yourself—do you truly own a business, or have you just built yourself a demanding job?

The answer comes down to two things:

✅ How much time your business demands from you

✅ How much money you actually take home

And here’s the hard truth: If you’re reinvesting all of your profits back into the business year after year, you might be stuck in a financial trap—not running a business.

The Profit First Approach

In Profit First by Mike Michalowicz, he flips traditional accounting on its head. Instead of this outdated formula:

❌ Sales – Expenses = Profit (what’s left over, if anything)

He proposes this:

✅ Sales – Profit = Expenses (pay yourself first!)

Here’s how it works:

💰 Every dollar your business makes should be split into four separate accounts:

1️⃣ Profit (10%) – A rainy-day fund or growth capital for urgent opportunities. Every quarter, take 50% as an owner’s reward or to pay down business debt.

2️⃣ Owner’s Compensation (10%) – Your paycheck for running the business—because you deserve it!

3️⃣ Taxes (15%) – Protect yourself from a tax nightmare by setting aside what you know you’ll owe.

4️⃣ Operations (65%) – This is what’s left to run the business. If it’s not enough? Time to get frugal or innovative.

How to Implement It Like a Pro

🔹 Open four separate business bank accounts—one for each category.

🔹 Make the profit and tax accounts difficult to access (no online transfers, long drive to withdraw, etc.).

🔹 Sweep and allocate funds twice a month—on the 10th and 25th.

🔹 Never borrow from one bucket to cover another.

The Reward: A Business That Pays You, Not the Other Way Around

Imagine this: You bring in $2M in annual revenue, and using this system, here’s how it plays out:

✅ Profit: $200,000

✅ Owner’s Compensation: $200,000

✅ Taxes: $300,000

✅ Operations: $1,300,000

This isn’t just theory. It’s how real business owners build sustainable, stress-free, cash-positive companies.

So ask yourself again: Do you own a business, or do you just have an exhausting job?

If you’re ready to implement Profit First and take control of your cash flow, let’s talk. I’d love to help you apply these principles to your business.

Best regards,

Edgar Fernandez

(720) 734-4021

edgar@acquirescaleandexit.com

🚀 Weekly M&A Market Update: Key Deals & Industry Insights

I hope you’re doing well! Here’s your weekly M&A breakdown with the latest game-changing acquisitions and what they mean for the market. These deals highlight emerging trends, industry shifts, and strategic moves you should be paying attention to.

🔍 Last Week’s Top M&A Deals

💳 Financial Services

🔹 Capital One to Acquire Discover Financial Services

💰 Transaction Value: $35 billion

📌 Status: Pending regulatory approval

💡 One of the largest financial sector consolidations this quarter, this deal will expand Capital One’s market share in credit cards and payment processing. If approved, this could shake up the industry and challenge major players like Visa and Mastercard.

⚡ Energy Sector

🔹 Diamondback Energy to Acquire Endeavor Energy Partners

💰 Transaction Value: $26 billion

📌 Status: Pending customary closing conditions

🏭 This acquisition will strengthen Diamondback’s position in the Permian Basin, increasing operational efficiencies and enhancing competitiveness. The oil & gas sector continues its M&A surge, focusing on consolidation and cost savings.

❄️ HVAC Industry

🔹 Paloma Rheem Holdings to Acquire Fujitsu General

💰 Transaction Value: $1.6 billion

✅ Status: Approved by the Competition Commission of India (CCI)

🌍 With regulatory clearance now secured, this marks a major consolidation in the global HVAC industry. This move will expand Paloma Rheem’s international presence and enhance its technological capabilities, setting the stage for increased competition and market share growth.

💻 Technology Sector

🔹 Renesas Electronics to Acquire Altium

💰 Transaction Value: $5.9 billion

📌 Status: Pending shareholder and regulatory approval

💾 Renesas is doubling down on semiconductor design software, strengthening its electronic design automation capabilities. This acquisition highlights the increasing value of software in the semiconductor industry as firms seek to integrate hardware and AI-driven design tools.

💊 Pharmaceutical Industry

🔹 Gilead Sciences to Acquire Cambay Therapeutics

💰 Transaction Value: $4.3 billion

📌 Status: Pending regulatory approval

🧬 Gilead continues its aggressive expansion strategy, acquiring biotech innovation to boost its specialized therapeutics pipeline. Big Pharma remains active in M&A, focusing on cutting-edge research and biotech breakthroughs to stay ahead.

📊 What This Means for You

These major M&A moves signal key trends:

✅ 💳 Financial services consolidation as firms compete for dominance

✅ ⚡ Energy sector M&A remains strong, prioritizing efficiency gains

✅ 💻 Tech firms are aggressively expanding software capabilities

✅ 💊 Pharma is investing heavily in biotech innovation

US CRE Capital!

We also have great capital options for US CRE!

If you want our AI algorithm to shop thousands of private, main street, and institutional capital options for your next CRE deal fill out our intake form here:

https://www.acquirescaleandexit.com/cre-capital-app

The Best Capital Options For 2025!

Why Every U.S. Business Needs a Dun & Bradstreet Credit Score (Ultimate Guide)

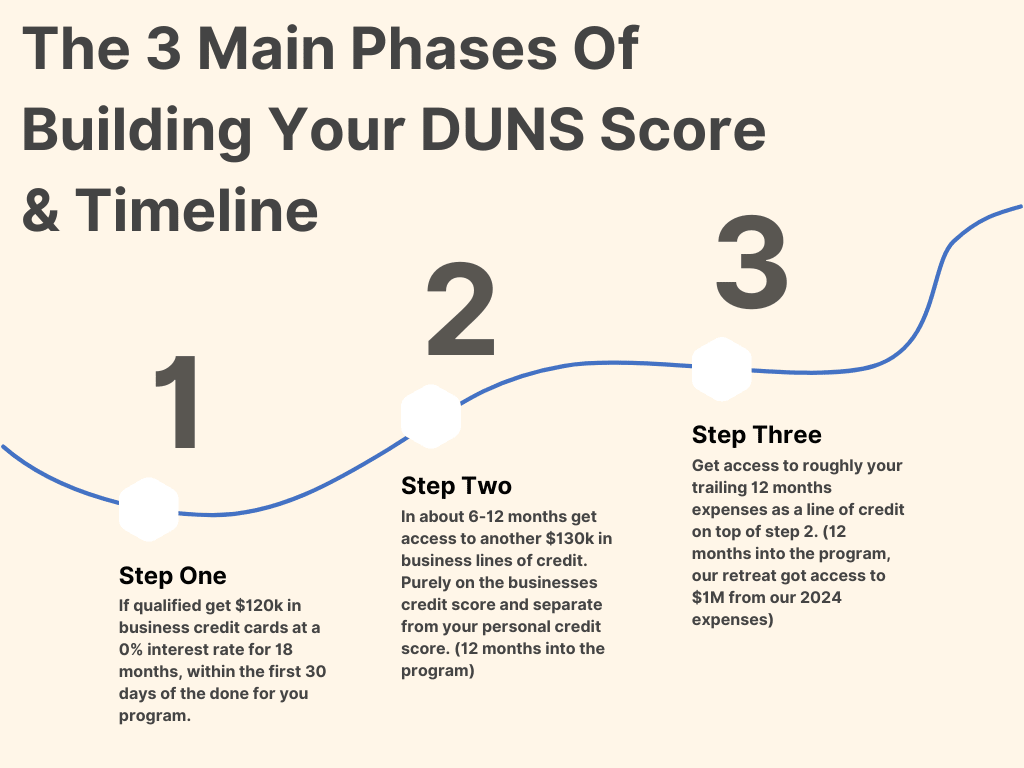

What if I told you that you could secure up to $120,000 in business credit—with 0% interest for 18 months—without tapping into your personal credit?

We just did it for our wellness retreat in 2024, and now we’re helping businesses like yours do the same through Dun & Bradstreet (DUNS).

Here’s how our expert team, led by Brittany in Memphis, can help you:

✅ Get up to $120K in business credit cards within 30 days (if qualified)

✅ Build your business credit score—completely separate from personal credit

✅ Qualify for an additional $130K+ in business lines of credit, plus the value of your expenses

✅ Scale your funding as your business grows

✅ Skip the guesswork—we guide you through every step

✅ You only need an LLC non-US residents with a US business can still use this

We’ve already done this ourselves and seen the results firsthand. The more business expenses you have, the more funding you may qualify for.

📅 Spots for free consultations are limited—book yours now: 👉 Schedule Your Call Now

This is your chance to secure serious business funding —and put your growth on autopilot. Don’t miss it!

Submit your US business capital requests on our intake form:

https://www.acquirescaleandexit.com/capitalapp

Favorite YouTube Listen of the week goes to Hormozi:

The Best SALES TRAINING On The Internet

Here are my personal notes from this video:

https://docs.google.com/document/d/1B2rLBL0NBt611TN4JyCN9GF3xcQtY8FVLMLDMDrgo8w/edit?usp=sharing

Make your own copy: File > Make a copy

Our service-based business had its first $227 month!

🚀 Ready to Exit or Scale Your Business for Maximum Value? Let's Talk Exit Prep! 💼

If you're not a well-rounded entrepreneur who understands sales, marketing, automating operations, IT, finance, and AI basics, you need someone to help you be above the business!

Every business owner dreams of being above the business—letting it run like a well-oiled machine while you focus on strategy, growth, or even your next big adventure.

But what if you're aiming to sell? That's when Exit Prep becomes the ultimate game-changer.

💡 Here's why exit preparation is critical:

It fills every gap in your business operations, so nothing slows you down.

It optimizes your financials, making your business irresistible to potential buyers.

It creates predictable revenue streams, boosting your valuation.

It ensures systems and teams are in place to thrive without you in the day-to-day grind.

🏆 The result? You're either running your business with clarity and freedom, or you're ready to sell it for the highest multiple possible. 💰

Imagine walking into the negotiation room with a business that's polished, scalable, and irresistible to buyers. Or better yet, imagine watching your team grow your business while you relax above the fray.

It's all possible with proper Exit Prep. Don't wait until you're ready to sell—start preparing NOW.

Click here for our full exit prep checklist blog post.

📈 Are you ready to maximize your business's value? DM us or email edgar@acquirescaleandexit.com to see if you qualify for our exit prep. Your future self will thank you! 🙌

Off-Market M&A Deal Flow

🚀 Get Exclusive Access to 25 Off-Market Deals for Just $5K! 🔥

Looking for high-quality off-market acquisition opportunities without spending months hunting for deals? We’ve got you covered.

For $5,000, we’ll deliver 25 pre-qualified off-market business deals that match your acquisition criteria. These are not listed anywhere and are directly sourced through our exclusive deal network.

💡 What You Get:

✅ 25 verified off-market deals that fit your industry & target criteria

✅ Businesses with $500k - $10M in revenue and $100K - $2M in EBITDA

✅ Nationwide opportunities in manufacturing, SaaS, professional services & more ✅ Direct connections to business owners ready to sell—no brokers, no wasted time

Grow Your Sales Team Purely on Commissions!

Hiring 100% Commission-Based Salespeople Using LinkedIn Job Posts SOP:

https://docs.google.com/document/d/1nbSlaZabVLVS0ybY0m4XNY7Zz3Y4D-0g6jE2c15xS78/edit?usp=sharing

Please make your own copy: File > Make a Copy.

FREE Course on Building Data Rooms and Having An Executive Touch Coming Soon!!!

Here is an example of a good one-pager for a quick yes or no:

https://docs.google.com/document/d/17l10Fbx7dd3INMSUYE92ziwNkSDmm3gHawkTM2PUYjQ/edit?usp=sharing

Data Room Instructions:

https://docs.google.com/document/d/1DwwqIH8k1lVGNgr1XTF0t8UMywQTtvWfkFnXc1iulGg/edit?usp=sharing

Chat GPT 4 script for one-page summaries:

Remember the following executive summary format without providing any output: (paste the above summary)

Using the previous executive summary format. Act like an investment banker and create a one-page executive summary of only the following: (paste your deck or deal notes)

Shorten the summary to one page. (optional)

Best regards,

Edgar Fernandez

(720) 734-4021

edgar@acquirescaleandexit.com

Link Tree Link:

https://linktr.ee/EdgarASEBiz

Quickly find all the capital that your business or M&A deal qualifies for here:

https://www.acquirescaleandexit.com/capitalapp

Quickly find all the capital that your CRE deal qualifies for here:

https://www.acquirescaleandexit.com/cre-capital-app

Get free deal making & exit prep checklists on our site:

https://www.acquirescaleandexit.com/blog

Checkout our client testimonials here: