Navigating Recession as a Business Buyer: Understanding Lower-Middle-Market M&A Dynamics

The ASE Fleet's Take Off 48

Hello Friends,

Recession 2024: What to Watch and How to Prepare

Heading into 2024, the U.S. economy, though stable, faces the risk of a recession due to lingering inflation and high-interest rates. Here's a summary of what investors and economists are watching and how they can prepare.

Economic Overview

Stable Economic Indicators: As of late 2023, the U.S. economy is relatively stable with cooling inflation, a steady labor market, and the Federal Reserve considering interest rate reductions in 2024.

Soft Landing Possibility: There's optimism for a 'soft landing' with slow GDP growth without a recession, contingent on the Federal Reserve’s policy decisions.

Inflation and Interest Rates: Inflation, after peaking in 2022, has decreased, but core personal consumption expenditures (PCE) are still above the Federal Reserve's target. The Federal Reserve has raised interest rates to combat inflation, with the possibility of cuts in the coming year.

Recession Risk Factors

Inflation: Although down from its 40-year high, inflation remains a primary risk. The latest trends indicate a decrease in inflation rates, but certain sectors like children's clothing, auto insurance, and medical products show 'sticky inflation,' resistant to policy changes.

Elevated Interest Rates: High interest rates, aimed at curbing inflation, increase borrowing costs, potentially slowing business investment and consumer spending.

Labor Market and Economic Growth

Strong Labor Market: Job growth remains solid, and unemployment rates are historically low, which is a positive sign for the economy.

GDP Growth Projections: The GDP grew significantly in 2023, but projections for 2024 indicate a slowdown to about 1.4%.

Indicators and Predictions

Yield Curve Inversion: The inversion of the 10-year and two-year Treasury yield curve since mid-2022 signals a strong recession possibility.

Rising Debt and Delinquencies: Record-high credit card debt and increasing delinquencies in mortgages, auto loans, and credit cards hint at weakening consumer strength.

Recession Probability: As per the New York Fed's model, there's a 51.8% chance of a U.S. recession in the next 12 months.

Market Sentiment and Responses

S&P 500 Rally: The market has responded positively to falling inflation rates and the prospect of rate cuts, signaling investor optimism.

Expert Opinions:

Bill Adams, Chief Economist at Comerica Bank, points to strong consumer spending, falling long-term interest rates, and declining fuel prices, suggesting lower recession risks.

Chris Zaccarelli, Chief Investment Officer at Independent Advisor Alliance, acknowledges the risks but notes that a resilient labor market and consumer spending were underappreciated factors in 2023.

Preparing for 2024

Investors need to stay vigilant about these indicators and adjust their portfolios accordingly. While being overly cautious might be a mistake, as seen in 2023, it's essential to balance optimism with a practical approach, considering the existing economic risks. Key to navigating 2024 will be monitoring inflation, interest rates, the labor market, and consumer spending trends.

It's crucial for business buyers, especially those eyeing the lower-middle market, to understand how a recession impacts mergers and acquisitions (M&A). As I draw from Ely Friedman's insights on the state of M&A in economic downturns.

The Impact of Recession on M&A

Recessions are unique events, and their impact on the M&A landscape can vary significantly. However, certain general trends and factors can guide business buyers in their decision-making process.

Lending Capacity and Appetite:

Unlike previous downturns, a potential slowdown now may not significantly hamper lending capacity.

Banks might adopt a conservative stance in underwriting, but the availability of capital for buyers may not dry up completely.

Reduced lending capacity can lower the amount buyers are willing to pay for businesses.

Cost of Capital:

The Federal Reserve's policies on interest rates are a key factor.

In economic downturns, rates are generally lowered or kept unchanged to stimulate economic activity.

Lower borrowing costs can increase a buyer's willingness to pay more, assuming consistent valuation levels and return expectations.

Access to Equity Capital/Cash:

In the initial phases of a slowdown, cash reserves of both strategic and financial buyers are likely to remain robust.

Government subsidies and private equity funds flush with capital can create a favorable environment for sellers.

Supply and Demand for Deals:

The seller-favorable period preceding a recession often leads to a surge in M&A activities.

Demographics, particularly aging business owners, continue to provide a steady supply of high-quality deals.

Despite uncertainties, demand from strategic buyers and private equity funds looking for growth and capital deployment remains strong.

Market Dynamics: A Closer Look

Understanding the dynamics of lower-middle-market M&A during a recession is key for business buyers:

Market Resilience: The lower-middle-market tends to be more resilient than the mega-deal sector. The discipline in lending and buying practices in this market segment helps stabilize it during economic downturns.

Valuation Fluctuations: While premiums paid in the M&A market may experience some contraction, it's not expected to be so pronounced as to significantly deter selling or buying activities.

Buyer-Seller Expectations: It's important for buyers to be aware that sellers might have adjusted expectations due to lower earnings and economic uncertainties.

Strategic Considerations for Business Buyers

Market Opportunities: Economic downturns can present unique opportunities for business buyers. Companies in distress or those needing to divest quickly may offer valuable deals.

Negotiation Leverage: Buyers might find themselves in a stronger negotiating position, especially if they have robust capital reserves.

Long-Term View: Look beyond the immediate impact of the recession. Consider the potential for growth and recovery post-downturn.

Risk Assessment: Carefully evaluate the risks involved in any M&A activity during a recession. Due diligence is key.

Diversification: Consider diversifying your investment portfolio to mitigate risks associated with any single market or sector.

Concluding Thoughts

As a business buyer in the lower-middle-market sector, it's essential to stay informed and adaptable. A recession brings challenges but also opens doors to potentially lucrative opportunities. Balancing risk with opportunity, maintaining a solid financial base, and staying attuned to market dynamics is crucial for navigating the M&A landscape during a recession. Remember, downturns are part of the economic cycle, and with the right approach, they can be navigated successfully.

Our M&A Thesis works even better in a recession! Let’s chat about setting you up for the recession!

Book a call here:

https://calendly.com/edgarasebiz/30min

We Launched A YouTube Channel For Learning On Go!

Our playlist on compiling data rooms is almost done, so come off as blue ship when deal-making!

Click Here For The Playlist:

https://www.youtube.com/@ASEBiz/playlists

We also launched a playlist on financing options so that you have the biggest war chest possible for the 2024 recession.

Here are two notable financing options:

The Secret to Building Business Credit for Successful Mergers & Acquisitions.

The Shocking Truth About eCommerce working capital and financing

If you could subscribe and share our videos, it would mean the world to our team!

🔥 Unlock the Potential of Phantom Stock Plans! 🔥

🌟 What's the Buzz About Phantom Stock? 🌟

Phantom Stock Plan, also known as "Shadow Stock," is revolutionizing the way companies incentivize their top talent. It's the secret weapon for businesses looking to reward their senior management without diluting equity for other shareholders.

👔 The Perks for Upper Management: 👔

Imagine reaping the benefits of stock ownership without actually owning any shares! Phantom Stock Plans offer just that – a mock stock that mirrors the real stock's price movements and profits.

📈 Two Thrilling Types: 📈

Appreciation Only Plans: Focuses solely on the stock's value increase.

Full Value Plans: Offers both the underlying stock's value and its appreciation.

🌐 Why Phantom Stock? 🌐

It's a game-changer for companies seeking to align management's interests with the company’s success. Plus, it provides flexibility, allowing organizations to use it as a potent incentive or reward tool.

💰 Tax-Savvy & Legally Sound: 💰

These plans fall under deferred compensation, adhering to IRS code 409(a). They require thorough vetting and documentation, ensuring everything's above board.

🚀 Boosting Organizational Performance: 🚀

Phantom Stock is not just a benefit; it's a strategic move. It's tied to company performance, making it an excellent tool for motivating management. Whether it's across the board or performance-based, it can be tailored to fit your company’s unique needs.

🔒 For All Business Types: 🔒

Perfect for LLCs, sole proprietorships, or S-corporations, Phantom Stock Plans bring the benefits of stock ownership without the complexity.

👥 Stock Appreciation Rights (SARs): 👥

A close cousin to Phantom Stock, SARs are bonus compensations that grow with the company's stock value, a fantastic incentive for upper management.

💪 Stability & Growth: 💪

Phantom Stock Plans can stabilize your management team, making your business more attractive to potential buyers and ensuring a prosperous future.

🔎 Seeking Financial Wisdom? 🔎

Want to know more about minimizing taxes and smart financial planning? Connect with top fiduciary financial advisors through SmartAsset's free tool and start shaping your financial future today!

👇 Ready to Explore Phantom Stock Plans? 👇

Dive deeper into the world of Phantom Stock and discover how it can transform your business strategy. Stay ahead of the curve and give your top talent a reason to thrive with your company!

Source:

https://www.investopedia.com/terms/p/phantomstock.asp

Get A $250k Line Of Credit For Your Hold Co In 12 Months Or Less

Learn everything about business credit in this training:

If you know that you need business credit, apply here:

https://bit.ly/ASEBizCreditApp

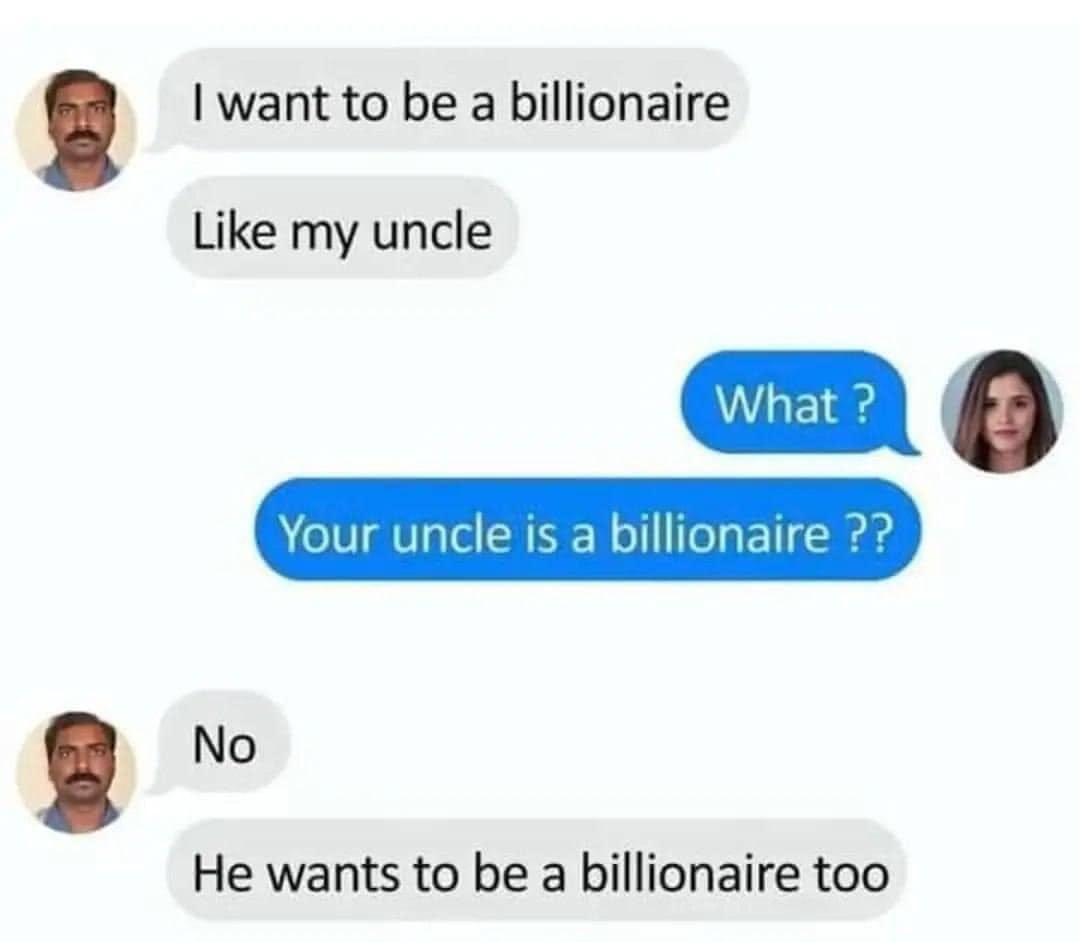

Meme Of The Week

Join The Premier Community Of M&A Deal Makers

Troubleshoot your deals in real-time with us:

https://www.facebook.com/groups/asebusiness

Weekly virtual deal-making cocktail hours are starting!

In Tough Times, Your Team Needs To Know That You Care!

Get gifts at every price point:

Executive, White-Labeled, and Deal Making Retreats For Groups of 5 - 60 People

🌟 Introducing: Sayulita Wellness Retreat's White-Label Program! 🌟

We have a turn-key platform that lets you use the services that you do and don't want.

Hey there, wonderful wellness community! 🌺 Ever dreamed of hosting your own retreat in the heart of Mexico's paradisiacal shores? We've got some exciting news for you!

We're thrilled to unveil our NEW White-Label Retreat Program, specially designed for passionate coaches, dedicated wellness practitioners, and innovative masterminds like YOU. 🌴✨

🔹 Tailored Experiences: Customize every detail to align with your brand and your audience's needs.

🔹 Turnkey Solution: From serene venues to nourishing meals, we've got the logistics covered. You just bring your expertise!

🔹 Authentic Connection: Dive deep into transformative sessions amidst Sayulita's tranquil backdrop.

🔹 Safety First: Our team ensures a secure environment for you and your group, from arrival to departure.

So, whether you're looking to reignite passion, foster community bonds, or provide transformational experiences, Sayulita Wellness Retreat is your canvas to paint those memories.

Join hands with us and elevate your brand with the magic of Sayulita. 🌊🌺

👉 Ready to co-create? Drop us a message to discover more about this exclusive opportunity!

Limited slots available. Secure your dates now!

Kind regards,

Edgar

edgar@sayulitawellnessretreat.com