Hello friends,

An uncommon and innovative approach in mergers and acquisitions.

Here is what you need to know.

Components:

Performance Indicators: The metrics used to measure the business’s success, such as customer satisfaction, employee retention, market share, and others.

Payment Plan: The schedule and calculation of payments, which can be based on performance targets.

Success Triggers: The conditions that signal the end of the Growth-Share period, such as reaching a specific market position, launching a new product, or fulfilling customer milestones.

Advantages:

Aligned Interests: By linking the purchase price to the success of the business, a Growth-Share structure promotes a shared goal for growth and aligns the interests of both the buyer and seller.

Deferred Payment: The buyer can defer a portion of the purchase price until the success of the business is demonstrated, reducing the upfront risk.

Minimized Risk: The buyer pays only for the success of the business, minimizing their risk.

Disadvantages:

Complexity: Negotiating a Growth-Share structure can be complex, particularly if there are disagreements about the performance indicators or payment plan.

Uncertainty: The seller may only know how much they will receive at the end of the Growth-Share period, creating uncertainty.

Conflict: The Growth-Share structure can lead to conflicts between the buyer and seller, especially if the performance indicators or payment plan are not well-defined.

Steps:

Identify Performance Indicators: The first step is to determine the performance indicators that will influence the payment, which should be relevant to the business and indicative of its future success.

Negotiate Payment Plan: The next step is to negotiate the payment plan, including the timing and calculation of the payments, ensuring both buyer and seller interests are taken into account.

Define Success Triggers: Clearly define the conditions that signal the end of the Growth-Share period, such as reaching a specific market position, launching a new product, or fulfilling customer milestones.

Conclusion:

The Growth-Share structure in M&A is an uncommon and innovative approach that promotes a shared goal for growth and minimizes the buyer’s risk. It is important to carefully consider the advantages and disadvantages and structure the arrangement equitably for both parties involved.

Source:

Meme Of The Week

Amazing Chat GPT Tutorial:

Post Of The Week

8 Secrets for Selling your Service-Based Business

Download Acquisition Aficionado Magazine today for the inside track into selling your service-based business by Edgar Fernandez. An accomplished marketing & growth consultant at Acquire Scale & Exit (ASE) as an experienced financial engineer getting M&A transactions to pay for themselves, He shares solid insights into what buyers are looking for to structure a viable offer.

Financial Architecting Tip Of The Week

The ASE Fleet's Financial Architecting Tool #20

Mezzanine Financing

"Mezzanine Financing: What Mezzanine Debt Is and How It's Used

Mezzanine financing is a hybrid of debt and equity financing that gives the lender the right to convert the debt to an equity interest in the company in case of default, generally after venture capital companies and other senior lenders are paid. In terms of risk, it exists between senior debt and equity.

Mezzanine debt has embedded equity instruments. Often known as warrants, attached, which increase the value of the subordinated debt and allow greater flexibility when dealing with bondholders. Mezzanine financing is frequently associated with acquisitions and buyouts, for which it may be used to prioritize new owners ahead of existing owners in case of bankruptcy."

Source: www.investopedia.com/

https://www.investopedia.com/terms/m/mezzaninefinancing.asp.

Deal Trophy Of The Week

Business Buyer Of The Week

Here is a list of all of our vetted buyers:

https://docs.google.com/spreadsheets/d/1oGisPRVIa2TsG4n_G8oNOrlLh2PoxiSObtJlRZISv7s/edit?usp=sharing

M&A Script Of The Week

The ASE Fleet's M&A Negotiation Bomb #2

"Would you be opposed to talking with your independent tax advisor about how you would benefit from x% of seller financing? Because capital gains tax is high, we want to set up a stream of cash flow that isn't over-taxed." - Edgar Fernandez

We put a man on the moon 54 years ago!

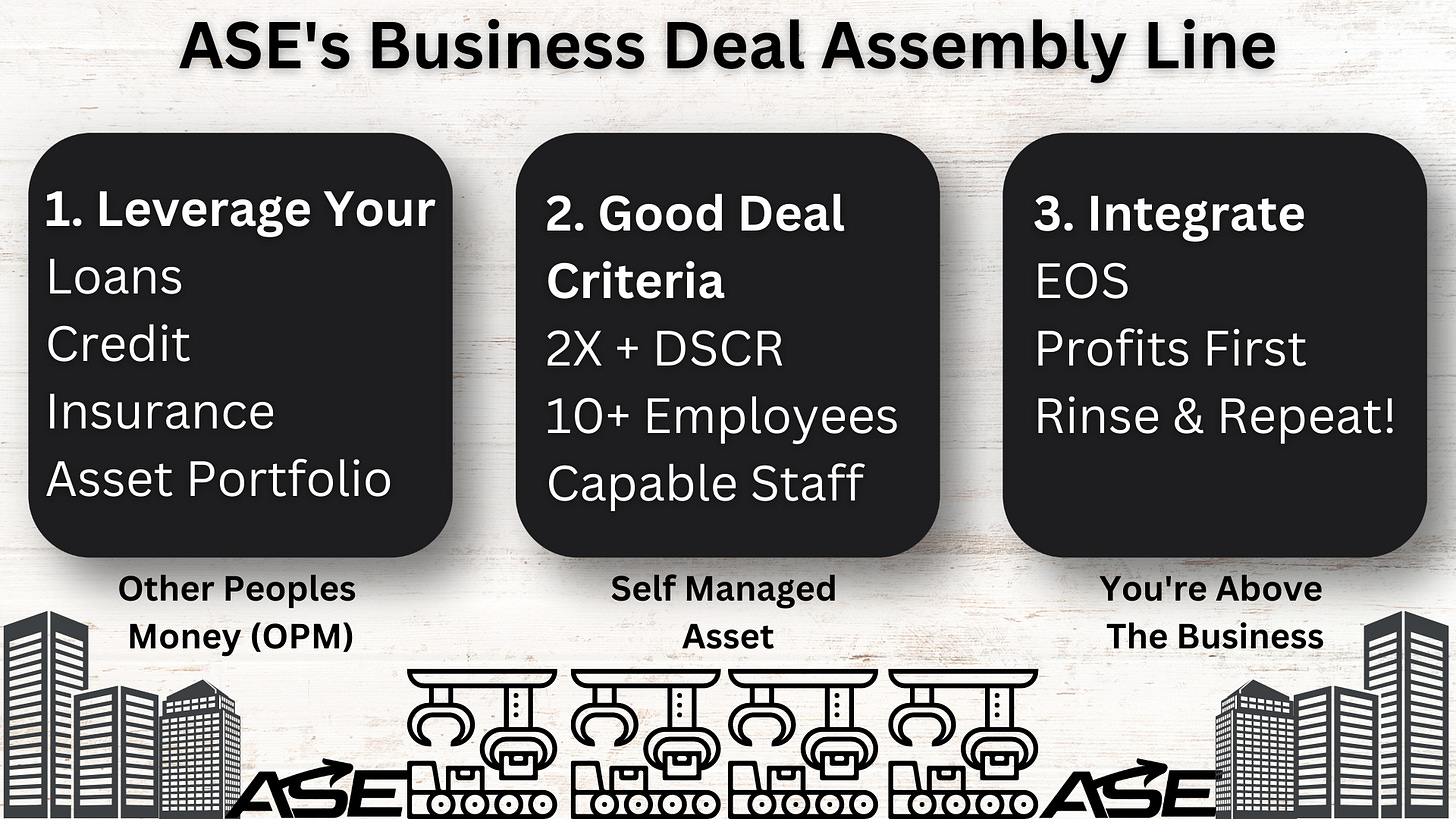

And luckily for you, closing M&A deals isn't rocket science, and it can be systemized!

ASE has a dedicated professional for each bullet point in our assembly line.

And in all honesty, having your own financial ducks in order is one of the fastest ways to leverage other people's money (OPM).

To that respect, ASE also has The Become Lender-Ready Program and a complimentary Financial Education Platform.

Our Deal Assembly Line is only a tiny part of our Become Your Own Private Equity Firm Consulting Kit.

If you're making more than $500k a year in sales and want to take your business to the moon DM me, and buckle your seat belt for take off!

Now here is some clarification on a few of the points in our infographic.

The Debt Coverage Service Ratio (DSCR) is how many times per month a company's net profit can pay for the debt service used to acquire the company after an M&A transaction is closed.

Integration is the final phase of the M&A lifecycle, where you optimize the company with systems, marketing, and by rallying the troops.

The Entrepreneurial Operating System (EOS) is an operating system for businesses that has proven to get companies higher multiples upon exit over and over.

Profits First is a model that flips the profit equation into Sales - Profit = Expenses.

Hopefully, this post connected some dots for you whether or not you work with us.

And tag us in a social media post if you implement any of this and get results; we love seeing others win!