Hello friends,

Here is a summary of Global M&A Industry Trends: 2023 Outlook by PWC.

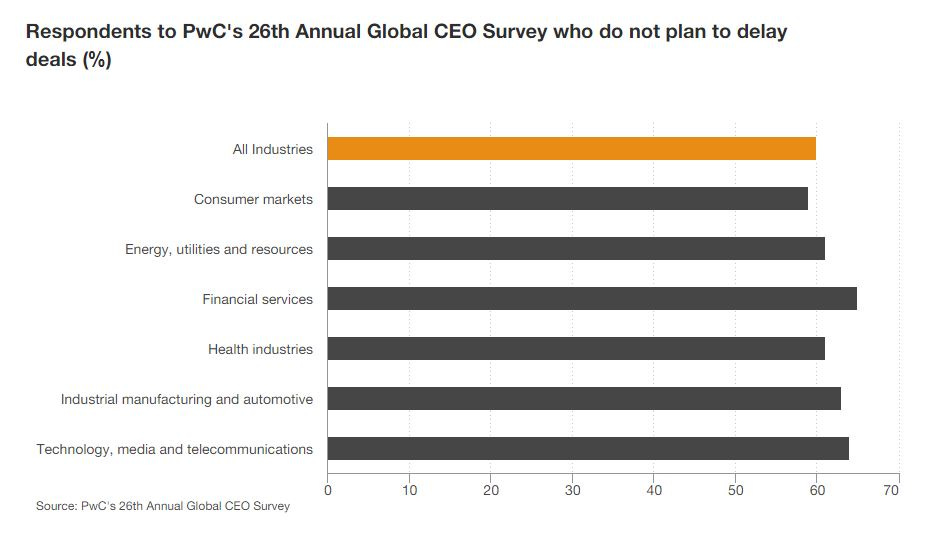

Mergers and acquisitions (M&A) may slow down during uncertain times, but they can also present opportunities for attractive valuations and transformative deals. Despite lower overall deal volumes in 2022 compared to the record-breaking year of 2021, the current market conditions suggest a sweet spot for M&A, provided companies have well-thought-out strategies and financial capabilities. Many C-suites and boards should embrace M&A as part of their strategy to accelerate digital and environmental, social, and governance (ESG) transformations of their businesses. With 73% of corporate leaders pessimistic about global economic growth, 60% are not planning to delay deals in 2023 to mitigate potential economic challenges and volatility, according to PwC's 26th Annual Global CEO Survey.

To navigate the dynamic environment for M&A plays, dealmakers should accelerate strategic reviews and portfolio optimization, build transformation into the narrative, get creative on financing, use lower valuations as a catalyst, seek growth in other markets, prioritize workforce strategy, scenario plan during due diligence, and identify additional sources of value. Corporates with cash on hand and growth ambitions will be well placed in this market, while private equity will be focused on creating value in their portfolio companies. Special purpose acquisition companies (SPACs) have struggled to close deals, and many are likely to run out of time. As banks seek to limit their exposure to some riskier sectors, we expect to see credit funds continue to take share away from banks.

Global M&A volumes and values declined in 2022 by 17% and 37%, respectively, from record-breaking 2021 levels, although both remained above 2020 and pre-pandemic levels. Deal volumes and values declined by 25% and 51%, respectively, in the second half of 2022 compared to the prior year period. However, trends varied across countries and regions. Asia-Pacific and Americas regions experienced declines, while Europe, the Middle East, and Africa (EMEA) performed better despite higher energy costs and a drop in investor confidence.

We expect 2023 to be an exciting time for M&A, with transformation and transactions at the forefront of CEOs' value-creation strategies. As business leaders seek to surmount varying challenges, M&A, particularly portfolio optimization, will be a key tool to help them reposition their businesses, bolster growth, and achieve sustained outcomes over the long term.

Source:

https://www.pwc.com/gx/en/services/deals/trends.html?fbclid=IwAR08SxPkIkO1LUcIhgbgS-7F7J81IEc5q6BJLd3aJfHmvNX1EkGWLtqc7jE

Memes Of The Week

Posts Of The Week

Deal Architecting Tip Of The Week

The ASE Fleet's Deal Architecting Tool #23

Earnouts

"An earnout is a contractual provision stating that the seller of a business is to obtain additional compensation in the future if the business achieves certain financial goals, which are usually stated as a percentage of gross sales or earnings.

If an entrepreneur seeking to sell a business is asking for a price more than a buyer is willing to pay, an earnout provision can be utilized. In a simplified example, there could be a purchase price of $1 million plus 5% of gross sales over the next three years."

Source: www.investopedia.com

https://www.investopedia.com/terms/e/earnout.asp

Our earnout pitch:

We have the best earn-outs in the industry vis-à-vis a ballooning profits interests and a second bite of the apple with equity in the newco for the owners that sell to us.

I mean, who doesn't like balloons and apples? Haha!

Deal Trophy Of The Week

M&A Script Of The Week

The ASE Fleet's M&A Negotiation Bomb #5

Do you have a set exit date for selling your business?

And on a scale of 1-10, how committed are you to selling?

ASE’s Deal Assembly Line

We put a man on the moon 54 years ago!

And luckily for you, closing M&A deals isn't rocket science, and it can be systemized!

ASE has a dedicated professional for each bullet point in our assembly line.

And in all honesty, having your own financial ducks in order is one of the fastest ways to leverage other people's money (OPM).

To that respect, ASE also has The Become Lender-Ready Program and a complimentary Financial Education Platform.

Our Deal Assembly Line is only a tiny part of our Become Your Own Private Equity Firm Consulting Kit.

If you're making more than $500k a year in sales and want to take your business to the moon DM me, and buckle your seat belt for take off!

Now here is some clarification on a few of the points in our infographic.

The Debt Coverage Service Ratio (DSCR) is how many times per month a company's net profit can pay for the debt service used to acquire the company after an M&A transaction is closed.

Integration is the final phase of the M&A lifecycle, where you optimize the company with systems, marketing, and by rallying the troops.

The Entrepreneurial Operating System (EOS) is an operating system for businesses that has proven to get companies higher multiples upon exit over and over.

Profits First is a model that flips the profit equation into Sales - Profit = Expenses.

Hopefully, this post connected some dots for you whether or not you work with us.

And tag us in a social media post if you implement any of this and get results; we love seeing others win!

Acquisition Aficionado Magazine 14th Issue is Live!

The 14th issue of Acquisition Aficionado Magazine is tricked out this month with awesome content from a high end line up of Acquisition & Exit experts. Solid content that you'll want to download and read right now!

Here don't take my word for it, just take a sneak peek for yourself at the M&A experiences, stories and success shared within this issue:

- The Form and Function Behind Our Unique Transactional Liability Coverage: 35 year veteran of the business insurance industry, Kevin Whaley, provides a brief overview of an exciting new transactional liability (TA) product for the SME market. This product is a trailblazer in the industry offering a unique sell side coverage!

- How2Exit: E85: Gregory Elfrink - Ron Skelton interviews the Director of Marketing at Empire Flippers

- PMG Business Services Takes Aim at Merger & Acquisition Needs Within the Plastics Manufacturing Industry: Explore the world of plastics manufacturing acquisitions with PMG Business Services.

- Are You in the Clear?, Successor Liability in Asset Acquisitions: Len Garza is the founder of GARZA, a law firm focused on protecting the personal and business assets of business owners. In this article, he discusses successor liability in asset acquisitions.

- Elevate Your M&A Game, Score Bigger Wins with an Improved Lead Generation Strategy: Finding and qualifying leads for M&A can be a time-consuming process. Join Josh Wilkinson as he provides some great points for your arsenal in generating leads for your M&A activity.

- Is Together Better? Why Integrate Your Acquisitions Technology: Many businesses integrate their acquisitions – and plenty don’t. In this informative article, Dave Refault weighs the benefits and the drawbacks of both sides so you are armed with the information you need to make the best decision.

- EP 227 of Deal Room, What the Heck is EBITDAC? The Brand New Acronym in Business Sales: Joanna Oakey of Aspect Legal talks with Cameron Ryan from Xcllusive Business Brokers about an interesting new term – EBITDAC. What does it stand for and how could it be relevant to you and your business?

- The Five Factors of Value You Need to Look at When Buying eCommerce Businesses: Branden Yamada provides 5 important factors to guide you in your acquisition search of eCommerce businesses.

- How to Structure an Earn-Out in an M&A Transaction: With the current economic uncertainty, earn-outs will likely become more popular as distressed sellers look to sell their businesses. Edgar Fernandez covers the key elements, advantages and disadvantages of using an earn-out, and the steps to structure an earn-out in an M&A transaction.

- Mitigating Risks with IT Due Diligence: The JPMorgan Chase & Bear Stearns Merger: One critical aspect of the M&A process is IT due diligence which is an evaluation of a company's IT infrastructure, applications, and processes. Joseph Augustine gives a ton of valuable information along with a detailed case study, in this article.

Information PLUS action is POWER so Act NOW to avoid missing out! Visit our website to download your free copy now while you still can - www.AcquisitionAficionado.com