Hello Freinds,

Here’s how to identify a motivated seller!

As a business owner, you should always have an exit plan whether you’re planning to sell or not. Like with a will, you hope never to use it, but you’ll have the peace of mind that it’s there. And if you never saw selling your company as a viable option to move into a new phase of your life. This post will provide you with a few questions that will help you come to a decision, along with some tips on setting up an emergency exit plan. But first, let’s review some of the common reasons why businesses go for sale on the market.

Here are the 9 main reasons why a business owner might want to sell their business:

Up-Cycle – If your industry is on an up-cycle, your business’s valuation multiple will be higher.

Relocation – Some businesses are tied to a specific geographical radius.

Shiny Object – You might own another company or be starting another company and lost focus or interest in the old company.

Retirement – Retirement is probably the most common reason why businesses go for sale, which is good because it preserves the jobs that the company provides.

Money – This could be for too many reasons to list both positive and negative.

Partners – Working with a bad partner is just as bad as staying in a bad relationship, and the company will usually benefit if one partner buys out the other or if they both exist.

Burn-out – This could be due to an underperforming partner, a change of priorities, new life circumstances, or being overworked and overstressed.

Health – In a health crisis, companies are sold to pay for medical expenses or because the owner literally can’t operate the business anymore.

Death – This could be the owner’s death, a partner’s, or a spouse’s.

Before we turn each of the 9 reasons into a question that you can ask yourself, let’s work through some high-level questions:

Are you happy at least 80% of the time at work?

Do you wake up excited to start the day and tap dance to work?

Does your business revolve around something that you’re passionate about?

What would you do if money wasn’t an issue, and you could do anything today?

Does the business interfere with your family life?

Do you wish you had more free time? What would you do with it?

Now let’s revisit each reason and see if one applies to you:

Upcycle – Is your industry currently in an upcycle? How far apart were all the previous upcycles, and what is the average amount of years between each upcycle? Do you see yourself successfully running your business until the next upcycle or should you sell now and cash out while you can?

Relocation – Can you successfully replicate your business in a new location?

Shiny Object – Is the old business wasting mental bandwidth that could be used on your main business? Can selling the old business fund your new idea with some runway?

Retirement – Age aside, do you have enough set aside to fund a comfortable retirement? If not, how much more runway will selling the company give you?

Note: (If you’re planning to turn the key on your business (close it down), don’t! Reach out to an M&A advisor or at least list it on Deal Stream and BizBuySell yourself at a 1x multiple for a quick sell).

Money – Are you eyeing an asset to treat yourself? (Make sure to communicate this with the buyer to see if that speeds up the transaction).

Partners – Do you feel like filling a restraining order on yourself for your partner’s safety? I’m joking, and on a more serious note, is your partner keeping up to the standards that were agreed upon in the original partnership agreement? Do you feel like you’re doing all the work and taking home the same as them or less?

Health – Will selling cover your medical expenses? Are you physically and mentally capable of maintaining the company?

Death – Would selling the company get you through or assist with any of the stages of grieving? If yes, which one(s) and how?

If you decided to sell, here are some questions that you might want to address quickly:

What’s the worst that can happen or what’s your biggest fear, and who/what can address it?

If the worst happened, would there be any damage? If yes, how could it be repaired?

What are the short-term and long-term benefits and outcomes?

What would selling do to your finances? Do you need controls in place for managing said funds?

What is it costing you not to sell physically, mentally, and financially?

What are you waiting for?

I mentioned an emergency exit plan earlier, which would be getting your Above the Business Score. Your ABS score will help you set up a turn-key business with systems that can change hands at the drop of a hat.

Get your ABS Score here: https://acquirescaleandexit.ck.page/7d0175d3ef

You don’t have to sell your business, but it’s something to consider if you’re on the fence.

If you want more information about why and how to sell your business, don’t hesitate to reach out! I’m always happy to give 10 minutes to entrepreneurs looking for answers.

Source: https://www.acquirescaleandexit.com/why-should-you-sell-your-business/

Meme Of The Week

When a delayed deal closes. 🤣

Post Of The Week

Deal Architecting Tip Of The Week

The ASE Fleet's Deal Architecting Tool #26

Reps & Warranties

"What Does Reps and Warranties Mean?

Reps and warranties is a term used to describe the assertions that a buyer and/or seller makes in a purchase and sale agreement. Both parties are relying on each other to provide a true account of all information and supporting documents to close the transaction.

The seller's representations usually relate to the information that the buyer is relying on to value the company. Therefore, the seller ends up not only stating that all financial information provided is true and accurate, but also having to deliver information to support this statement such as financial statements, customer and supplier listings, copies of all major contracts, equipment listings, etc. This information all forms part of the schedules to the purchase and sale agreement, and may be referred back to post transaction to ensure that what was effectively purchased truly does exist.

The buyer's representations usually relate to the form of consideration being used to complete the transaction. If the buyer's stock is part of the transaction consideration, then the buyer must represent that it is legally able to offer this stock. In addition, the buyer must provide a shareholder agreement for the seller to review and state that the stock is being offered free and clear of any encumbrances."

Source: www.divestopedia.com

https://www.divestopedia.com/defi.../889/reps-and-warranties

Deal Trophy Of The Week

M&A Script Of The Week

Here are all of our off-market companies for sale and a list of vetted business buyers incase you're looking for a quick close:

https://docs.google.com/document/d/1wU2ZctV_KZnNDPpS_NNpLNp2nhNMLxOn5YbVZIwlyQU/edit?usp=sharing

You ought to bookmark this link; it's a live Rolodex.

And it's best viewed on PC for a clickable table of contents on the left.

Here's ASE's Top Capital Partners - No Ceiling:

https://docs.google.com/document/d/11Tr-1UPG9wQQcLvsTK58HSJMjtoGkNzyXkEPPy5wfuk/edit?usp=sharing

We're selling our video SaaS!

$2.1M Video Delivery B2B SaaS

Summary: This company uses AI and machine learning to deliver a end-to-end video delivery systems. (Basically customers are buying a smart-tailored version of Netflix’s back-end video management & delivery system). The company was launched to cache mobile video only, but the current CEO had a bigger vision and pivoted the company. We are now looking for a strategic buyer to help with the automation, marketing, and overall growth of the company. This company has the potential to be the go-to video specific CDN (cloud delivery network) for all companies and video creators.

Key Financials:

Ask: $2.1M

2022 Numbers:

Sales $755k

COGS $32k

Gross Profit $439k

Net Profit $294k

Multiple 6.8x Net Profit

Asking Price (Owner Financing Available): $2,100,000 at closing we are selling for a low multiple to retain a 30% + equity stake in the company.

Reason For Selling: The company has $700k in debt that can be erased for $350k. And the current management team wants to replace the idle cap table with a more active strategic partner.

USP:

TIME: 15 day out-of-the-box implementation (Web, iOS, Android, Roku, AppleTV, Android TV, Fire, and more).

COST: Stack ownership and low operating costs facilitates aggressive subscription pricing; our patented profiling technology offers smart caching and streaming to decongest mobile networks and minimize operating costs

MONETIZATION: An feature rich, data-driven end-to-end platform serving the full digital ecosystem by increasing revenues for content publishers through common monetization models (subscription, transactional, PPV, ad-based, live streaming). targeted advertising and enhanced mobile user experiences.

Risk Management:

Time to market - the company has to quickly ramp up sales to establish its market share

The normal hurdles that come with scaling a company are the only issue. Scalable.co would be a great option for scaling.

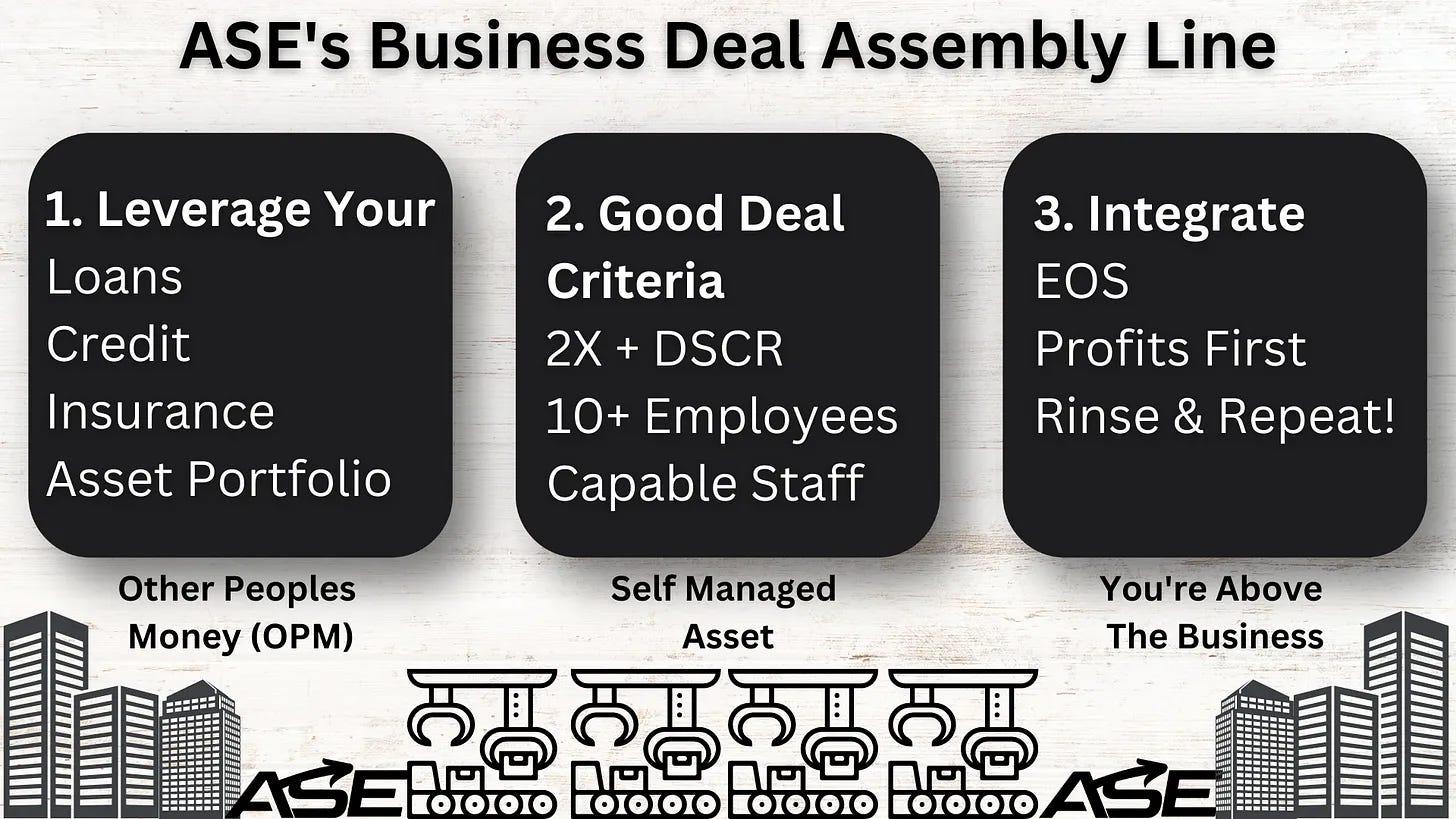

ASE’s Deal Assembly Line

We put a man on the moon 54 years ago!

And luckily for you, closing M&A deals isn't rocket science, and it can be systemized!

ASE has a dedicated professional for each bullet point in our assembly line.

And in all honesty, having your own financial ducks in order is one of the fastest ways to leverage other people's money (OPM).

To that respect, ASE also has The Become Lender-Ready Program and a complimentary Financial Education Platform.

Our Deal Assembly Line is only a tiny part of our Become Your Own Private Equity Firm Consulting Kit.

If you're making more than $500k a year in sales and want to take your business to the moon DM me, and buckle your seat belt for take off!

Now here is some clarification on a few of the points in our infographic.

The Debt Coverage Service Ratio (DSCR) is how many times per month a company's net profit can pay for the debt service used to acquire the company after an M&A transaction is closed.

Integration is the final phase of the M&A lifecycle, where you optimize the company with systems, marketing, and by rallying the troops.

The Entrepreneurial Operating System (EOS) is an operating system for businesses that has proven to get companies higher multiples upon exit over and over.

Profits First is a model that flips the profit equation into Sales - Profit = Expenses.

Hopefully, this post connected some dots for you whether or not you work with us.

And tag us in a social media post if you implement any of this and get results; we love seeing others win!