Hello there folks,

When you’re in the game of business acquisitions, it's not just about having deep pockets; it's about being creative and strategic. I’ve seen countless deals fall through because the parties involved took a one-dimensional approach. When I heard about the opportunity to acquire a thriving Metal Fabrication Shop, I was immediately intrigued by its impressive financials. However, the challenge was the $5M asking price. But with an innovative deal stack, we sealed the deal. Here are the deal stack options that we had ready to go before LOI.

1. Inventory/Equipment/Materials Consignment:

The idea of buying all the assets outright is tempting but comes with its financial challenges. We decided to adopt a consignment approach. By acquiring the company or LLC but leaving the seller in possession of $1M of assets, we reduced our upfront cost. This setup was designed as a win-win: the seller was protected, and we had an option to buy back the assets when more funds became available. This approach immediately addressed the $1M cash down payment requirement, making it more manageable.

2. Vendor & Supplier Loans:

Relationships in business are everything. When considering how to approach vendors and suppliers, we crafted the following pitch:

"Hello, I wanted to inform you that I currently own a fabrication shop and I'm in the process of acquiring this second one. I understand that you've been a trusted vendor/supplier for this shop. While I already have my own set of vendors and suppliers, I would truly love to continue the business relationship that's been established with you. If you could consider extending a loan to assist in this acquisition, not only would we continue our business dealings, but as I venture into purchasing more companies in the future, you'll be at the forefront of our business partnerships."

By framing our intentions in this manner and highlighting the potential for continued and expanded business, several vendors and suppliers were open to the idea of extending loans. Whether it was in the form of cash, credit, or a line of credit (LOC), these partnerships allowed us to chip away at the company's debt and address part of the seller financing.

3. Revenue-Based Financing:

While traditional financing methods often depend on hard assets or profitability metrics, Revenue-Based Financing (RBF) takes into consideration the company’s revenue streams. Given the Metal Fabrication Shop's impressive revenue of over $7.7M, this was an attractive option. By pledging a percentage of future revenues to investors, we secured funds that went towards the acquisition without diluting equity.

4. Equipment and Inventory Loans:

The Metal Fabrication Shop came with over $3.8M in equipment, not to mention significant inventory in raw materials, work-in-progress, and finished goods. Instead of viewing these merely as assets, we saw them as collateral. Equipment and inventory loans provided another financial layer, allowing us to leverage these assets for additional capital.

5. Spot Factoring:

With over $833K in accounts receivable, we identified an opportunity in spot factoring. By selling these invoices to a third party at a discount, we generated immediate cash post-closing, further reducing the financial strain.

6. SBA:

Although we opted not to initially acquire via the Small Business Administration (SBA) due to potential liabilities, we kept this option on the table for future refinancing. If we had bought the assets outright, this avenue would be open to us two years down the line, providing an opportunity for favorable loan terms and rates.

In conclusion, acquiring the Metal Fabrication Shop was no simple task, but with a multifaceted approach, we turned potential obstacles into opportunities. Business, much like basketball, is about strategy and adaptability. By diversifying our financing approach and leveraging relationships, assets, and innovative financial instruments, we made a slam-dunk acquisition. In the game of business, always remember that the traditional playbook might not be the only way to win. Sometimes, thinking outside the box scores the biggest points.

Outsource School is the best resource for implementing the 4-Hour Work Week and automating everything!

👇

Click here to automate the core areas of your business without breaking the bank.

Meme Of The Week

Post Of The Week

🔥 Transform Your Acquisition & Outreach Strategy! 🔥

Introducing "Ultimate Connect" - The zenith in M&A, B2B, and B2C lead gen automation!

🔹 M&A Enthusiasts: Unlock boundless M&A opportunities. Say goodbye to cold calls and embrace a future of smart, data-driven acquisitions tailored for your criteria.

🔹 B2B Leaders: Revolutionize your B2B connections. Ditch old-school methods and harness high-quality, verified leads, ensuring seamless collaboration.

🔹 B2C Mavericks: Upgrade your consumer outreach. Dive into a sea of potential customers with insights and engagement tools designed for optimal reach.

Features:

✅ Automated lead generation across M&A, B2B, and B2C sectors.

✅ Seamless engagement across Email, SMS, Chat, and Social Media platforms.

✅ Comprehensive data verification and insights for every lead.

Step into the future of business growth with "Ultimate Connect"!

Email me "Learn More" to redefine success and be the ultimate game-changer TODAY!

edgar@acquirescaleandexit.com

Venture into a new era of acquisition and outreach. Lead. Dominate. Thrive.

In the dynamic world of business, the proactive lead. Don't be left behind. Act NOW!

Deal Architecting Tip Of The Week

The ASE Fleet's Deal Architecting Tool #30

"What Is a Bill of Lading?

A bill of lading (BL or BoL) is a legal document issued by a carrier (transportation company) to a shipper that details the type, quantity, and destination of the goods being carried. A bill of lading also serves as a shipment receipt when the carrier delivers the goods at a predetermined destination. This document must accompany the shipped products, no matter the form of transportation, and must be signed by an authorized representative from the carrier, shipper, and receiver.

KEY TAKEAWAYS

A bill of lading is a legal document issued by a carrier to a shipper that details the type, quantity, and destination of the goods being carried.

A bill of lading is a document of title, a receipt for shipped goods, and a contract between a carrier and a shipper.

This document must accompany the shipped goods and must be signed by an authorized representative from the carrier, shipper, and receiver.

If managed and reviewed properly, a bill of lading can help prevent asset theft.

There are different types of bills of lading, so it’s important to choose the right one."

Source: Investopedia

https://www.investopedia.com/terms/b/billoflading.asp

Resources & Free Deal Stack Consultation

Get your FREE Deal Stack Consultation In The Below Google Doc.

Here's ASE's Available Acquisitions, Buyers, Deal Flow Options, and Capital Partners - No Ceiling:

https://docs.google.com/document/d/1wU2ZctV_KZnNDPpS_NNpLNp2nhNMLxOn5YbVZIwlyQU/edit?usp=sharing

Incase you need help with anything.

You ought to bookmark this link; it's a live Rolodex.

And it's best viewed on PC for a clickable table of contents on the left.

Here is a video walk-through:

https://www.loom.com/share/20d44c7409b541f481f4b8ee4d0b926a

This loom video explains how we operate and our capital options.

Join The Premier Community Of M&A Deal Makers

Troubleshoot your deals in real-time with us:

https://www.facebook.com/groups/asebusiness

Bi-weekly virtual deal-making cocktail hours are coming soon.

Deal Trophy Of The Week

M&A Script Of The Week

Corporate and Deal Making Retreats For Groups of 4 - 32 People

✨ Elevate Your Team’s Potential: New Corporate Retreats at Sayulita!

In the heart of nature’s tranquility, where the rhythmic waves of the sea and the gentle whispers of the forest converge, magic happens. And it's here at Sayulita Wellness Retreat that we're thrilled to introduce our newest offering!

🌿 Introducing: Corporate and Deal Making Retreats 🌿

Designed exclusively for groups of 4-8, this retreat is tailored to combine the power of focused team-building, holistic wellness, and strategic ideation. If you're seeking an immersive experience that transcends the confines of traditional boardrooms and ignites creativity, collaboration, and clarity, this is for you.

What to Expect:

Strategic Workshops: Dive into curated sessions aimed at fostering innovative thinking, efficient deal-making, and strengthening team dynamics.

Holistic Wellness: Recharge with our signature wellness activities, from meditation sessions to nature walks, ensuring your team remains rejuvenated.

Dedicated Space: Enjoy private spaces designed for brainstorming, discussions, and deal-making amidst serene settings.

Cultural Immersion: Enrich your retreat with local experiences – from guided tours to gourmet feasts, introducing a unique touch to your corporate getaway.

This retreat is not just about business; it's about finding harmony between work and well-being, ensuring every decision, deal, or development is infused with clarity, compassion, and creativity.

Bookings are now open for the upcoming quarter. Considering the exclusivity of this offering, slots are limited.

🌿 Email us to reserve your retreat: edgar@sayulitawellnessretreat.com 🌿

Expand horizons, foster growth, and forge deals – all while embracing the ethos of holistic well-being. Let's redefine what a corporate retreat looks like, together.

Lastly, don’t forget to take advantage of our great referral program and we always have slots for individuals too!

Warm Regards,

Corporate Retreats Coordinator

Sayulita Wellness Retreat

P.S. Each retreat can be personalized to suit your team’s unique needs and aspirations. Let’s co-create an unforgettable experience!

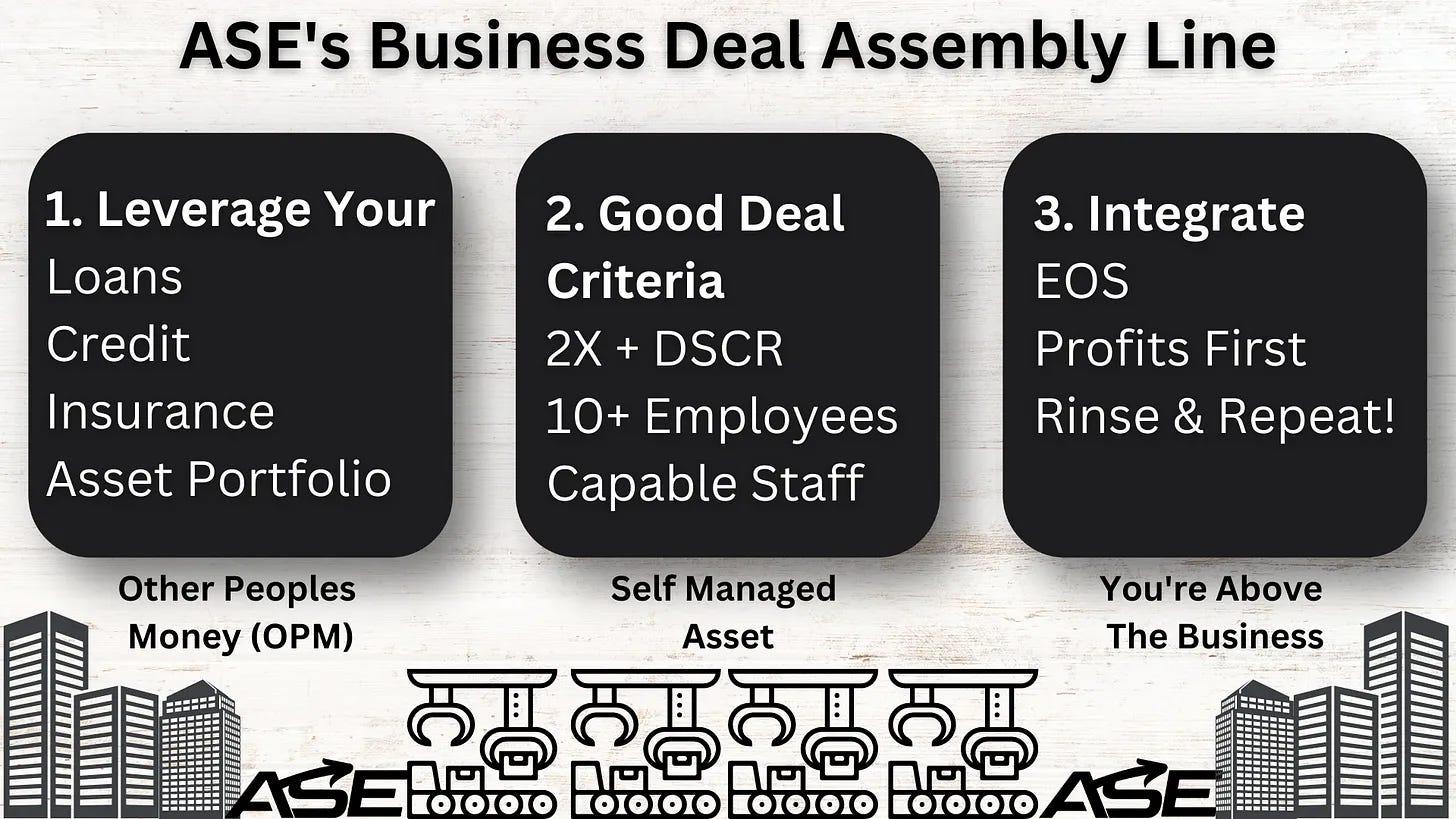

ASE’s Deal Assembly Line

We put a man on the moon 54 years ago!

And luckily for you, closing M&A deals isn't rocket science, and it can be systemized!

ASE has a dedicated professional for each bullet point in our assembly line.

And in all honesty, having your own financial ducks in order is one of the fastest ways to leverage other people's money (OPM).

To that respect, ASE also has The Become Lender-Ready Program and a complimentary Financial Education Platform.

Our Deal Assembly Line is only a tiny part of our Become Your Own Private Equity Firm Consulting Kit.

If you're making more than $500k a year in sales and want to take your business to the moon DM me, and buckle your seat belt for take off!

Now here is some clarification on a few of the points in our infographic.

The Debt Coverage Service Ratio (DSCR) is how many times per month a company's net profit can pay for the debt service used to acquire the company after an M&A transaction is closed.

Integration is the final phase of the M&A lifecycle, where you optimize the company with systems, marketing, and by rallying the troops.

The Entrepreneurial Operating System (EOS) is an operating system for businesses that has proven to get companies higher multiples upon exit over and over.

Profits First is a model that flips the profit equation into Sales - Profit = Expenses.

Hopefully, this post connected some dots for you whether or not you work with us.

And tag us in a social media post if you implement any of this and get results; we love seeing others win!