Want to Dominate Your Market? Here’s Why M&A is Your Secret Weapon 🚀

ASE's Weekly Takeoff - Sunday, February 23, 2025

Hi {{ subscriber.first_name }},

Hope you’re crushing it this week! I’ve been thinking a lot about how the biggest players in business keep getting bigger—and spoiler alert—it’s not by playing small.

One of the fastest, smartest ways to scale isn’t grinding for years trying to gain market share. It’s M&A—buying out competitors and merging with them to dominate the market overnight.

Just take a look at some of last week's biggest M&A moves:

🔥 ExxonMobil’s $59.5B acquisition of Pioneer → They just solidified their position as the undisputed king of U.S. fracking.

🔥 Home Depot’s $18.25B takeover of SRS Distribution → Because when you’re already the leader in home improvement, you double down and own the entire space.

🎢 Cedar Fair & Six Flags merge into an $8B thrill ride empire → The theme park giants are combining forces to create the ultimate entertainment powerhouse.

🥤 Celsius’ $1.8B acquisition of Alani Nu → The energy drink wars are heating up, and Celsius isn’t just competing—they’re taking over.

The key takeaway?

M&A isn’t just for billion-dollar companies. Whether you’re running a startup or an established business, the same principles apply:

✅ Instantly increase your market share → Why spend years chasing customers when you can acquire them overnight?

✅ Expand your capabilities & technology → Don’t reinvent the wheel—acquire proven systems & IP.

✅ Bring top talent into your business → Growth is easier when you acquire a team of experts already in place.

✅ Leverage distribution & infrastructure → Scale faster with an existing customer base & supply chain.

Instead of trying to out-compete, why not out-strategize?

At Acquire Scale Exit, we help business owners, investors, and dealmakers navigate M&A opportunities to grow, exit, or expand into new markets. Whether you're considering a strategic acquisition or looking to sell for the highest multiple, our team is here to guide you.

📅 Let’s talk about your M&A strategy—book a confidential consultation today, by sending us a quick one-pager on your M&A needs.

You’ve built something great. Let’s make it extraordinary.

Best regards,

Edgar Fernandez

(720) 734-4021

edgar@acquirescaleandexit.com

10 Business & Economic Predictions for 2025

What if I told you that nuclear energy is making a comeback, Elon Musk might buy TikTok, and "Buy Now, Pay Later" could soon turn into "Buy Now, Poor Later"?

These aren’t just hot takes. These are the top 10 business and economic predictions for 2025, as revealed by Biz Doc, that could shape everything from M&A deals to market trends and your next big move.

Let’s get into it.

🔟 Nuclear Energy Is Back Data centers are sucking up massive amounts of power, leading companies like Oracle to seek nuclear reactor permits. Meanwhile, China is building 25 new nuclear plants, while the U.S. is building… one. Expect a nuclear resurgence to power high-demand industries.

9️⃣ CNN or MSNBC Will Be Sold (But Not Both) Legacy media is bleeding money and losing viewers. One of these networks will likely be acquired in 2025—Biz Doc predicts MSNBC is the most likely to sell. The deal could happen at the Allen & Co. Conference, where all the big media players gather for high-stakes negotiations.

8️⃣ AI Will Keep Dominating, But It’s Shifting AI was the #1 investment category in 2024, and that won’t change. But expect the focus to shift from AI models (like ChatGPT) to AI tools—practical applications for businesses and industries that need automation.

7️⃣ Tariffs Will Be Tactics, Not Taxes If Trump returns to office, expect tariffs to be used as leverage in negotiations with China and Mexico, rather than as broad tax hikes. Smart businesses will adjust supply chains ahead of time.

6️⃣ Inflation Is Down, But Not Dead Inflation is stubbornly hanging around 3%—not high enough to be a crisis, but still impacting businesses. The Fed might cut rates, but don’t expect a dramatic drop in borrowing costs.

5️⃣ 30-Year Mortgage Rates Won’t Drop Below 6.25% If you’re hoping for 5% mortgage rates again, think again. Even with rate cuts, housing inventory is tight, and lending costs remain high. Renting will still be the more affordable option for most Americans.

4️⃣ Buy Now, Pay Later (BNPL) Will Become "Buy Now, Poor Later" Defaults on BNPL loans will skyrocket in 2025, as credit card debt surpasses $1 trillion. New regulations are likely coming to rein in the industry before it turns into another subprime crisis.

3️⃣ Nvidia Won’t Double Again – But It’ll Still Grow Nvidia’s record-breaking growth is slowing down. Expect a more reasonable 25% gain in 2025 as the company solidifies its position as the AI chip leader.

2️⃣ The S&P 500 Will Settle at 6,600 After years of wild market swings, 2025 will likely be a more normal 10% gain year. The “Magnificent 7” stocks that drove 2023-24 growth won’t carry the market forever.

1️⃣ Elon Musk Will Try to Buy TikTok Here’s the biggest wildcard: Musk making a bid for TikTok. With Trump pushing for a U.S. partner, Musk acquiring TikTok for X (Twitter) would give him the advertising dominance X has been missing—and reshape digital media.

So, What Does This Mean for You?

🔹 Business owners: Watch for nuclear-backed energy investments, AI tools, and tariff impacts.

🔹 Investors: Get positioned in AI, energy, and tech before the big moves happen.

🔹 M&A Dealmakers: Media consolidation, distressed BNPL companies, and underutilized manufacturing facilities will present opportunities.

2025 is shaping up to be a massive year for business, investment, and strategic deals.

Want to discuss how to capitalize on these trends? Let’s connect.

Source:

Biz Doc's Top 10 Business Predictions for 2025

US CRE Capital!

We also have great capital options for US CRE!

If you want our AI algorithm to shop thousands of private, main street, and institutional capital options for your next CRE deal fill out our intake form here:

https://www.acquirescaleandexit.com/cre-capital-app

The Best Capital Options For 2025!

Why Every U.S. Business Needs a Dun & Bradstreet Credit Score (Ultimate Guide)

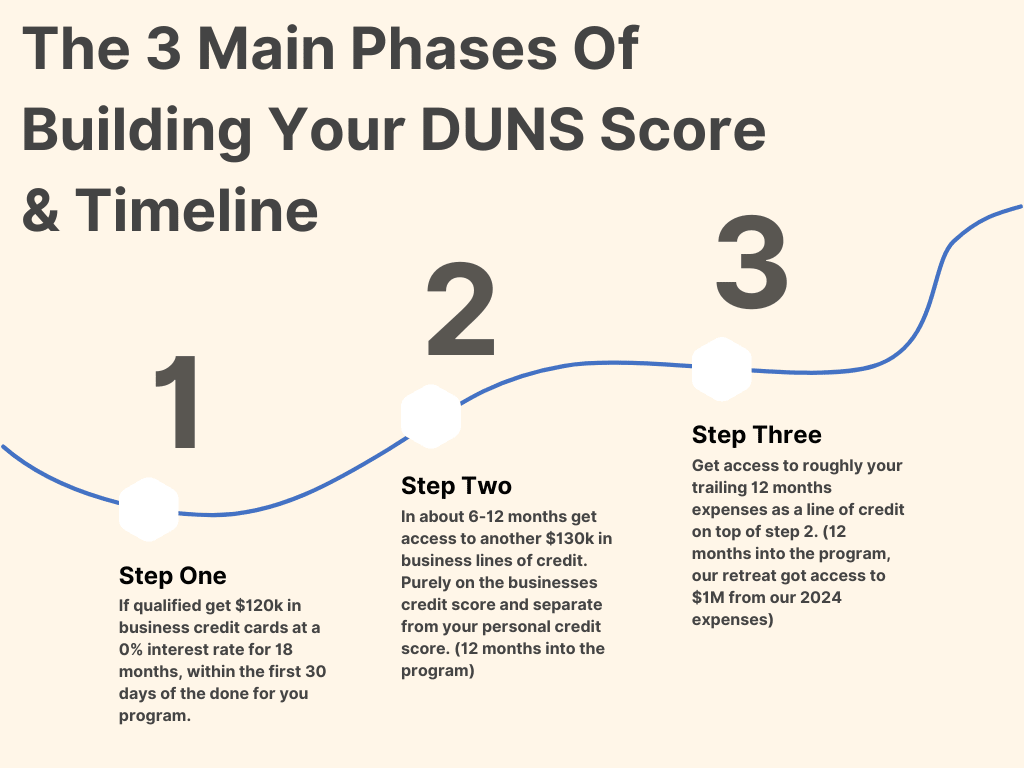

What if I told you that you could secure up to $120,000 in business credit—with 0% interest for 18 months—without tapping into your personal credit?

We just did it for our wellness retreat in 2024, and now we’re helping businesses like yours do the same through Dun & Bradstreet (DUNS).

Here’s how our expert team, led by Brittany in Memphis, can help you:

✅ Get up to $120K in business credit cards within 30 days (if qualified)

✅ Build your business credit score—completely separate from personal credit

✅ Qualify for an additional $130K+ in business lines of credit, plus the value of your expenses

✅ Scale your funding as your business grows

✅ Skip the guesswork—we guide you through every step

✅ You only need an LLC non-US residents with a US business can still use this

We’ve already done this ourselves and seen the results firsthand. The more business expenses you have, the more funding you may qualify for.

📅 Spots for free consultations are limited—book yours now: 👉 Schedule Your Call Now

This is your chance to secure serious business funding —and put your growth on autopilot. Don’t miss it!

Submit your US business capital requests on our intake form:

https://www.acquirescaleandexit.com/capitalapp

Favorite YouTube Listen of the week goes to Tim Ferris:

From Homeless and Broke to Top Angel Investor

(Uber, SpaceX, and 100+ More) — Cyan Banister

Laugh of the week

Our service-based business had its first $227 month!

🚀 Ready to Exit or Scale Your Business for Maximum Value? Let's Talk Exit Prep! 💼

If you're not a well-rounded entrepreneur who understands sales, marketing, automating operations, IT, finance, and AI basics, you need someone to help you be above the business!

Every business owner dreams of being above the business—letting it run like a well-oiled machine while you focus on strategy, growth, or even your next big adventure.

But what if you're aiming to sell? That's when Exit Prep becomes the ultimate game-changer.

💡 Here's why exit preparation is critical:

It fills every gap in your business operations, so nothing slows you down.

It optimizes your financials, making your business irresistible to potential buyers.

It creates predictable revenue streams, boosting your valuation.

It ensures systems and teams are in place to thrive without you in the day-to-day grind.

🏆 The result? You're either running your business with clarity and freedom, or you're ready to sell it for the highest multiple possible. 💰

Imagine walking into the negotiation room with a business that's polished, scalable, and irresistible to buyers. Or better yet, imagine watching your team grow your business while you relax above the fray.

It's all possible with proper Exit Prep. Don't wait until you're ready to sell—start preparing NOW.

Click here for our full exit prep checklist blog post.

📈 Are you ready to maximize your business's value? DM us or email edgar@acquirescaleandexit.com to see if you qualify for our exit prep. Your future self will thank you! 🙌

Off-Market M&A Deal Flow

🚀 Get Exclusive Access to 25 Off-Market Deals for Just $5K! 🔥

Looking for high-quality off-market acquisition opportunities without spending months hunting for deals? We’ve got you covered.

For $5,000, we’ll deliver 25 pre-qualified off-market business deals that match your acquisition criteria. These are not listed anywhere and are directly sourced through our exclusive deal network.

💡 What You Get:

✅ 25 verified off-market deals that fit your industry & target criteria

✅ Businesses with $500k - $10M in revenue and $100K - $2M in EBITDA

✅ Nationwide opportunities in manufacturing, SaaS, professional services & more

✅ Direct connections to business owners ready to sell—no brokers, no wasted time

Grow Your Sales Team Purely on Commissions!

Hiring 100% Commission-Based Salespeople Using LinkedIn Job Posts SOP:

https://docs.google.com/document/d/1nbSlaZabVLVS0ybY0m4XNY7Zz3Y4D-0g6jE2c15xS78/edit?usp=sharing

Please make your own copy: File > Make a Copy.

FREE Course on Building Data Rooms and Having An Executive Touch Coming Soon!!!

Here is an example of a good one-pager for a quick yes or no:

https://docs.google.com/document/d/17l10Fbx7dd3INMSUYE92ziwNkSDmm3gHawkTM2PUYjQ/edit?usp=sharing

Data Room Instructions:

https://docs.google.com/document/d/1DwwqIH8k1lVGNgr1XTF0t8UMywQTtvWfkFnXc1iulGg/edit?usp=sharing

Chat GPT 4 script for one-page summaries:

Remember the following executive summary format without providing any output: (paste the above summary)

Using the previous executive summary format. Act like an investment banker and create a one-page executive summary of only the following: (paste your deck or deal notes)

Shorten the summary to one page. (optional)

Best regards,

Edgar Fernandez

(720) 734-4021

edgar@acquirescaleandexit.com

Link Tree Link:

https://linktr.ee/EdgarASEBiz

Quickly find all the capital that your business or M&A deal qualifies for here:

https://www.acquirescaleandexit.com/capitalapp

Quickly find all the capital that your CRE deal qualifies for here:

https://www.acquirescaleandexit.com/cre-capital-app

Get free deal making & exit prep checklists on our site:

https://www.acquirescaleandexit.com/blog

Checkout our client testimonials here: