Hello there folks,

Have you ever caught yourself daydreaming about cashing out? Feel that itch to explore new adventures or simply take a well-deserved breather? Here's the secret: the universe might be throwing you a hint, and it's louder than ever! Dive into these 5 explosive reasons why selling your business through Mergers and Acquisitions (M&A) is the master move you've been waiting for. Prepare to be convinced; your golden moment is RIGHT NOW! 🌟

1. Dive Deep & Ride the Wave! 🌊 Venturing into the unknown? Make it EPIC! With M&A, you don’t just step, you LEAP into new markets. Imagine a sales software dynamo joining forces with a project management guru - that's not just growth, that’s an EXPLOSION!

2. Go Big or Go Home - Slash Those Costs! 💸 Merge, streamline, and SUPERCHARGE! Cut those pesky redundancies and ride the economy of scale like a boss. Fewer overheads + optimized processes = Cha-ching! 💰

3. The More, The Merrier - Offer ALL The Things! 🎉 Why settle? Boost your brand by adding even MORE to your plate. Think of an office supply hero partnering with a print mastermind. More offerings = More ka-ching moments!

4. Talent Fest - Let’s Rock with New Skills! 🎸 M&A isn’t just merging businesses; it's a festival of talents! Dive into new expertise and jazz up your offerings. New faces, fresh ideas - what's not to love?

5. Make an Exit, But Make It FLASHY! 🌟 Thinking of hanging up those boots? Do it in style! With M&A, ensure your brainchild thrives and dances under the disco lights of a bigger stage.

In a Nutshell? M&A is the wild roller coaster your business has been waiting for! Yes, there are twists and turns, but strap in, because the rewards are sky-high! 🚀

Stay stoked and watch out for more electrifying insights!

Meme Of The Week

Post Of The Week

🚀 Boost Your Sales Game with Josh Sweetnam! 🚀

Dreaming of closing more deals in M&A or simply amplifying your overall business prowess? 🌟 We've got just the thing for you!

I'm elated to introduce you to my phenomenal business partner, Josh Sweetnam. He’s been my sales coach for the past few weeks, and the transformation? Absolutely groundbreaking! Now, he’s collaborating with Maddison Brusman for the ultimate Energy Training for Sales on 9/12/23. And the best part? It's all happening over Zoom. And guess what? You're invited!

Believe me when I say: poor communication is often the hidden barrier in many M&A endeavors. But with Josh’s insights and strategies, you're set to navigate and conquer.

🔥 Why Join?

Decode the secrets of compelling communication.

Dive deep into tried-and-true sales strategies tailored for M&A success.

Network virtually with like-minded professionals and learn directly from the experts.

Details:

📅 Date: 9/12/23

📍 Location: Zoom (Link will be provided upon RSVP)

Email me for details: edgar@acquirescaleandexit.com

Deal Architecting Tip Of The Week

The ASE Fleet's Deal Architecting Tool #29

SFO #2

Family Office (FO) seeking professional business services, marketing/ lead gen agencies, sales team, enablement, BPO, biz dev, insurance agencies, M&A advisory firm, small investment management firm & investment bank doing $2M-$10M+ EBITDA. 70-80% cash to seller at closing. Price to be between the 3X-5X EBITDA.

Buyer profile: Hybrid between platform, financial, and strategic buyer family office + PE funds. They have a proven track record & nice portfolio of companies ranging from retail to manufacturing and more.

Most attractive Sellers: want chunk of cash up front, can carry 20-30% of the deal, give up control to a better operator, retain active role in company for a min. a few years time horizon, seeking scale or let it operate independently. Most importantly, the family office proven to be a safe pair of hands for the owner's companies they done business with. Sell wholly or majority okay.

My role: Collaborator/deal generator using multi-channels approach. Transactions based.

Fee structure: fee at closing or equity in the deal after it closes.

Resources & Free Deal Stack Consultation

Get your FREE Deal Stack Consultation In The Below Google Doc.

Here's ASE's Available Acquisitions, Buyers, Deal Flow Options, and Capital Partners - No Ceiling:

https://docs.google.com/document/d/1wU2ZctV_KZnNDPpS_NNpLNp2nhNMLxOn5YbVZIwlyQU/edit?usp=sharing

Incase you need help with anything.

You ought to bookmark this link; it's a live Rolodex.

And it's best viewed on PC for a clickable table of contents on the left.

Here is a video walk-through:

https://www.loom.com/share/20d44c7409b541f481f4b8ee4d0b926a

This loom video explains how we operate and our capital options.

Join The Premier Community Of M&A Deal Makers

Troubleshoot your deals in real-time with us:

https://www.facebook.com/groups/asebusiness

Bi-weekly virtual deal-making cocktail hours are coming soon.

Deal Trophy Of The Week

M&A Script Of The Week

Corporate and Deal Making Retreats For Groups of 4 - 32 People

✨ Elevate Your Team’s Potential: New Corporate Retreats at Sayulita!

In the heart of nature’s tranquility, where the rhythmic waves of the sea and the gentle whispers of the forest converge, magic happens. And it's here at Sayulita Wellness Retreat that we're thrilled to introduce our newest offering!

🌿 Introducing: Corporate and Deal Making Retreats 🌿

Designed exclusively for groups of 4-8, this retreat is tailored to combine the power of focused team-building, holistic wellness, and strategic ideation. If you're seeking an immersive experience that transcends the confines of traditional boardrooms and ignites creativity, collaboration, and clarity, this is for you.

What to Expect:

Strategic Workshops: Dive into curated sessions aimed at fostering innovative thinking, efficient deal-making, and strengthening team dynamics.

Holistic Wellness: Recharge with our signature wellness activities, from meditation sessions to nature walks, ensuring your team remains rejuvenated.

Dedicated Space: Enjoy private spaces designed for brainstorming, discussions, and deal-making amidst serene settings.

Cultural Immersion: Enrich your retreat with local experiences – from guided tours to gourmet feasts, introducing a unique touch to your corporate getaway.

This retreat is not just about business; it's about finding harmony between work and well-being, ensuring every decision, deal, or development is infused with clarity, compassion, and creativity.

Bookings are now open for the upcoming quarter. Considering the exclusivity of this offering, slots are limited.

🌿 Email us to reserve your retreat: edgar@sayulitawellnessretreat.com 🌿

Expand horizons, foster growth, and forge deals – all while embracing the ethos of holistic well-being. Let's redefine what a corporate retreat looks like, together.

Lastly, don’t forget to take advantage of our great referral program and we always have slots for individuals too!

Warm Regards,

Corporate Retreats Coordinator

Sayulita Wellness Retreat

P.S. Each retreat can be personalized to suit your team’s unique needs and aspirations. Let’s co-create an unforgettable experience!

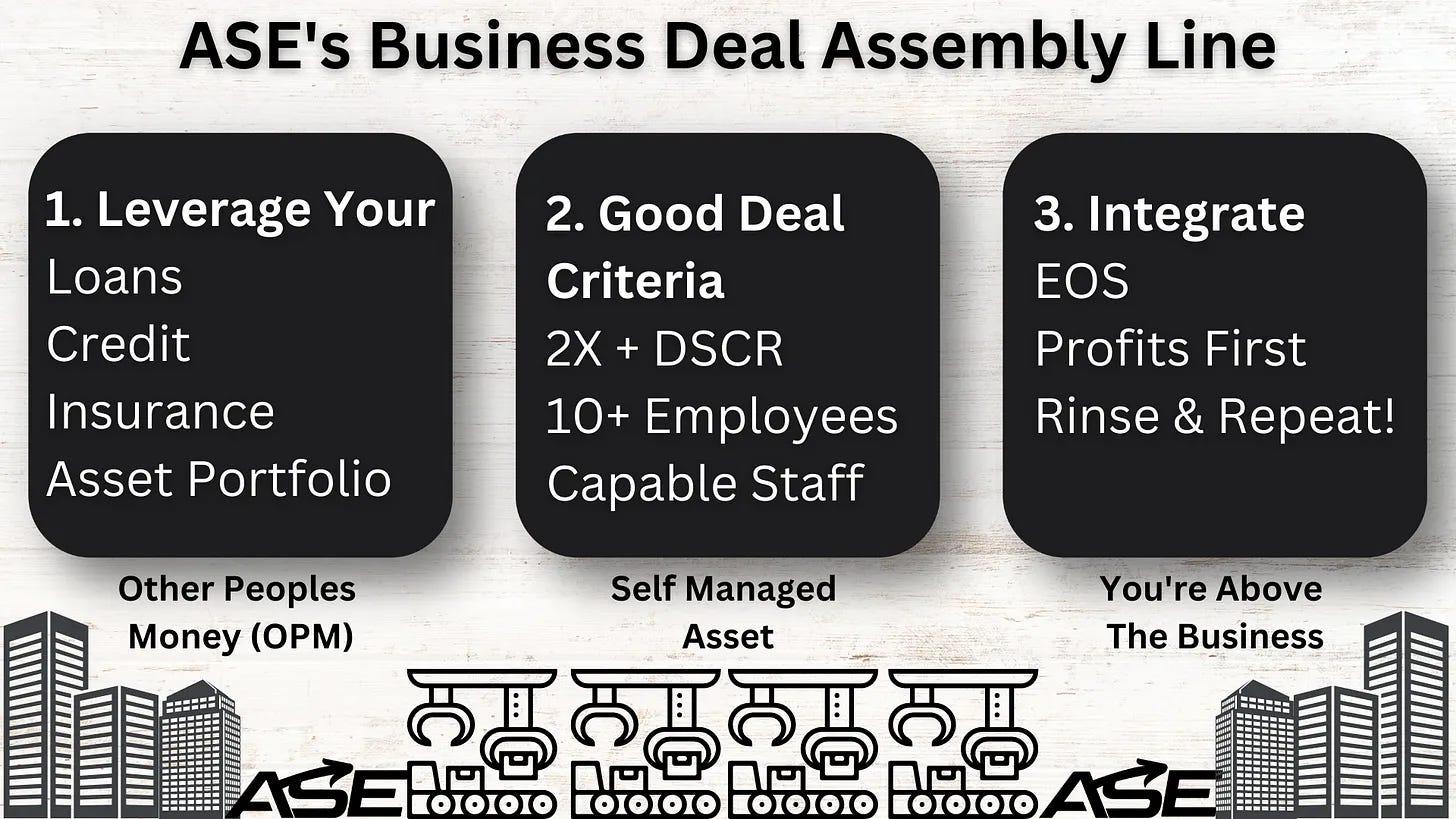

ASE’s Deal Assembly Line

We put a man on the moon 54 years ago!

And luckily for you, closing M&A deals isn't rocket science, and it can be systemized!

ASE has a dedicated professional for each bullet point in our assembly line.

And in all honesty, having your own financial ducks in order is one of the fastest ways to leverage other people's money (OPM).

To that respect, ASE also has The Become Lender-Ready Program and a complimentary Financial Education Platform.

Our Deal Assembly Line is only a tiny part of our Become Your Own Private Equity Firm Consulting Kit.

If you're making more than $500k a year in sales and want to take your business to the moon DM me, and buckle your seat belt for take off!

Now here is some clarification on a few of the points in our infographic.

The Debt Coverage Service Ratio (DSCR) is how many times per month a company's net profit can pay for the debt service used to acquire the company after an M&A transaction is closed.

Integration is the final phase of the M&A lifecycle, where you optimize the company with systems, marketing, and by rallying the troops.

The Entrepreneurial Operating System (EOS) is an operating system for businesses that has proven to get companies higher multiples upon exit over and over.

Profits First is a model that flips the profit equation into Sales - Profit = Expenses.

Hopefully, this post connected some dots for you whether or not you work with us.

And tag us in a social media post if you implement any of this and get results; we love seeing others win!