Why Rising Interest Rates Haven't Dented Small Business Valuations

The ASE Fleet's Weekly Take Off 39

Hello Freinds,

We've been hearing quite a bit of buzz in the financial community about the potential impact of rising interest rates on small business valuations. Many predicted a downturn, yet the small business market remains resilient. We wanted to delve deeper into this for our Acquire Scale & Exit newsletter readers and have highlighted 5 key reasons why these valuations remain robust despite the climbing rates:

Robust ROI Levels: Small businesses are not largely rate-sensitive, thanks to their robust unlevered ROI lying in the ballpark of 25-50%. Whether at 6% interest or even 10-11%, the math still favors these deals.

Real Estate Investors Venturing Out: With many real estate enthusiasts finding themselves cash-rich yet frozen out of their traditional market due to these rates, there's been a noticeable shift. They're turning their attention (and capital) to the SMB sector, injecting even more liquidity.

Surge in New Buyers: The demand for top-tier SMBs is skyrocketing, with an influx of new buyers. Did you know that while SBA-approved deals have surged by 18% this year, real estate transactions have dipped by 19%? The classic supply/demand curve suggests stable prices for SMBs.

Bigger Down Payments: To counteract the cash flow implications of higher interest rates, buyers are stepping up their game. They're making larger down payments to secure their desired acquisitions, providing a buffer against the cost of borrowing.

Friendly Seller Financing: Sellers keen on preserving their business valuations are chipping in too. Many are offering Seller Financing at more appealing terms, ensuring deals close at the desired valuations.

In summary, while the landscape may be shifting due to changing interest rates, the SMB market remains a dynamic and resilient arena. For those looking to acquire, scale, or exit, it's a world still ripe with opportunities.

Stay tuned to the Acquire Scale & Exit newsletter for more insights into the ever-evolving world of business!

Get Credit based financing here:

Meme Of The Week

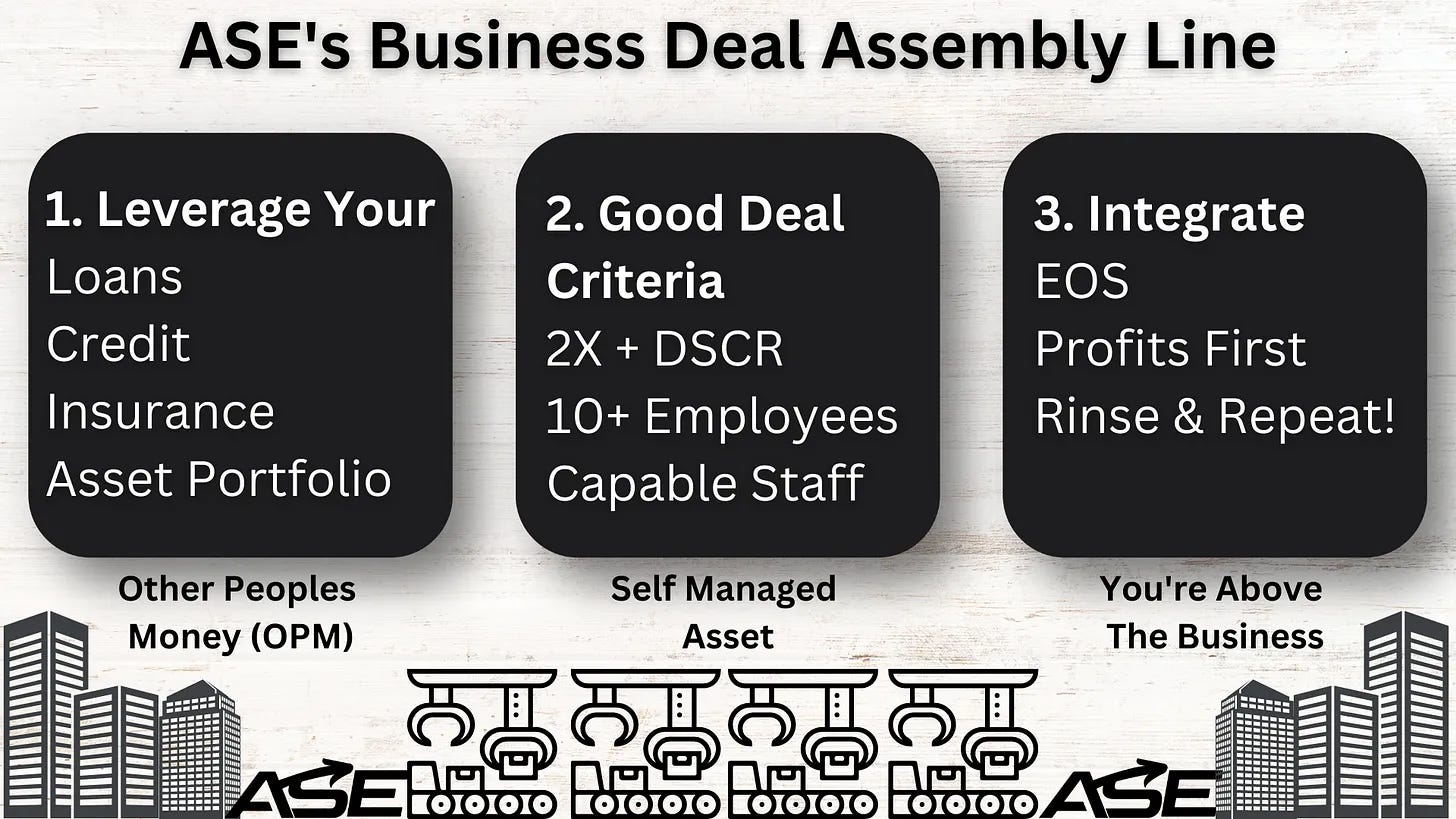

Post Of The Week

Unlock Unlimited M&A Deal Flow! 🚀

Attention M&A Professionals! Tired of slow and inconsistent leads? Imagine having 5-10 targeted, high-quality leads coming in, every single month... without the manual grind.

🔥 Introducing: The Perfect Pipeline M&A Workshop 🔥

LIVE on Zoom, where we'll dive into:

✅ Perfecting your online presence: Be the profile every business owner wants to engage with.

✅ Full automation: Systemize your outreach so leads come to you, not the other way round.

✅ Mastering discovery calls: Make them effective, under 15 minutes, and irresistible.

Highlights:

🔵 Proven outreach messages (tested & approved)

🔵 Word-for-word discovery script

🔵 Scale like a boss with strategies & real examples

🔵 Outreach expansion beyond LinkedIn

🔵 Dedicated Q&A time: All your burning questions answered!

BONUSES!

Get the exact blueprint we use to scale our outreach with a dedicated team, so you can too.

Dates: Choose from Aug. 25th or Sept. 1st, both at 3pm PT.

For just $97, transform your M&A game from a trickle of leads to an overflowing pipeline.

Why settle for mediocre deals? Elevate your M&A journey with unlimited, self-managed deal flow. Take control, set your terms, and let's scale together! 💼🚀

👉 Limited spots available. Secure yours now!

https://workshop.ascendcompany.net/perfect-pipeline-ef

#DealFlowRevolution 🌊

Deal Architecting Tip Of The Week

Single Family Office (SFO) – Search Fund

This family office buys companies for 100% ownership and works with finders in 2 ways:

1. If you want to be inactive post close, you get a few equity points in the new SPV.

2. If you are an operator or have an operating team, you can get more equity post close.

a. The above are the only two options they don’t do real estate, commodities, or bridge loans.

b. For both options above they create a new SPV and give the finder/searcher equity in the newco.

Only buys in 4 states:

1. Texas

2. Louisiana

3. North Carolina

4. Florida

The main criteria is revenue and they buy between $5M and $75M.

- They pay 1x revenue and no more.

- He also likes at least a 25% gross margins.

- The deals have to be off market and cannot have brokers.

They prefer B2B, manufacturing, Series A+, oil companies, and the following:

“In Texas, we like oilfield manufacturing like machine shops, job shop, CNC machines, wireline, tools, tool rental, pipeline maintenance, welding, engineering, staffing, plastics like extrusion, plastic molding, 3d printing, and alloy foundries, and small run silicone, and IT services...

That's not a definitive list.

We like robotics, robotic integrators, fabrication, and environmental remediation... We like certain kinds of mining too.”

Closing timeline: 60 – 90 days

Resources & Free Deal Stack Consultation

Get your FREE Deal Stack Consultation In The Below Google Doc.

Here's ASE's Available Acquisitions, Buyers, Deal Flow Options, and Capital Partners - No Ceiling:

https://docs.google.com/document/d/1wU2ZctV_KZnNDPpS_NNpLNp2nhNMLxOn5YbVZIwlyQU/edit?usp=sharing

Incase you need help with anything.

You ought to bookmark this link; it's a live Rolodex.

And it's best viewed on PC for a clickable table of contents on the left.

Here is a video walk-through:

https://www.loom.com/share/20d44c7409b541f481f4b8ee4d0b926a

This loom video explains how we operate and our capital options.

Lastly, check out our Stellar M&A Group:

https://www.facebook.com/groups/asebusiness

Join The Premier Community Of M&A Deal Makers

Troubleshoot your deals in real-time with us:

https://www.facebook.com/groups/asebusiness

Corporate and Deal Making Retreats For Groups of 4 - 8 People

✨ Elevate Your Team’s Potential: New Corporate Retreats at Sayulita!

In the heart of nature’s tranquility, where the rhythmic waves of the sea and the gentle whispers of the forest converge, magic happens. And it's here at Sayulita Wellness Retreat that we're thrilled to introduce our newest offering!

🌿 Introducing: Corporate and Deal Making Retreats 🌿

Designed exclusively for groups of 4-8, this retreat is tailored to combine the power of focused team-building, holistic wellness, and strategic ideation. If you're seeking an immersive experience that transcends the confines of traditional boardrooms and ignites creativity, collaboration, and clarity, this is for you.

What to Expect:

Strategic Workshops: Dive into curated sessions aimed at fostering innovative thinking, efficient deal-making, and strengthening team dynamics.

Holistic Wellness: Recharge with our signature wellness activities, from meditation sessions to nature walks, ensuring your team remains rejuvenated.

Dedicated Space: Enjoy private spaces designed for brainstorming, discussions, and deal-making amidst serene settings.

Cultural Immersion: Enrich your retreat with local experiences – from guided tours to gourmet feasts, introducing a unique touch to your corporate getaway.

This retreat is not just about business; it's about finding harmony between work and well-being, ensuring every decision, deal, or development is infused with clarity, compassion, and creativity.

Bookings are now open for the upcoming quarter. Considering the exclusivity of this offering, slots are limited.

🌿 Email us to reserve your retreat: edgar@sayulitawellnessretreat.com 🌿

Expand horizons, foster growth, and forge deals – all while embracing the ethos of holistic well-being. Let's redefine what a corporate retreat looks like, together.

Lastly, don’t forget to take advantage of our great referral program and we always have slots for individuals too!

Warm Regards,

Corporate Retreats Coordinator

Sayulita Wellness Retreat

P.S. Each retreat can be personalized to suit your team’s unique needs and aspirations. Let’s co-create an unforgettable experience!